We built Vox Markets to help investors stay informed and up to date about the companies they follow in the market.

As our user base grows and we add more features, we wanted to make sure our community was making the most out of a few key things Vox Markets helps you do, such as personalising your RNS alerts – one of our most requested tips.

So to ensure you are getting the most out of Vox Markets, we have drawn up a list of 4 essential tips to help you succeed on the platform.

In this short guide, you will learn how to:

-

Follow companies & stocks you are interested in

-

Get email alerts & mobile push notifications about the companies you follow

-

Personalise your push notifications & RNS alerts

-

Find full details about public companies

1. Follow companies & stocks you are interested in

Vox Markets is the easiest way to track news and updates about the public companies you are interested in.

To get updates about a company, you just need to follow them on Vox Markets, which makes all updates about that company appear in your main timeline.

These updates could be an RNS alert, a press mention, newly published research, or a post by a company director.

Which companies can I follow on Vox Markets?

On Vox Markets, you can get updates about any UK listed company, whether FTSE, Main or AIM.

How do I follow a company on Vox?

To follow a company, you simply search for them by name or ticker and click “Follow”.

This will add them to your Watchlist, which is what we call your personalised list of companies that you follow.

To follow a company on Vox Markets:

-

Search for any UK listed company in the search bar (by name or ticker) and click their name

-

When the company page opens, click the “Follow“ button next to their logo and ticker

-

Then add them to your Watchlist by clicking “Follow” on the pop-up that appears

2. Get email alerts & mobile push notifications about companies you follow

Vox Markets ensures you are the first to know about news updates on the companies you track.

And although updates about the companies you follow in your Watchlist automatically appear in your timeline, you can also choose to get two different types of instant alerts sent directly to you:

-

Email alerts

-

Mobile app push notifications

Below, we have detailed how to enable them both.

Setting up email alerts

What email alerts can I get?

On Vox, you can get email alerts for the following:

How do I set them up?

To get email alerts about your watched companies, open the website on desktop then:

-

Click the Menu button ( ) in the top right

) in the top right

-

Choose Settings, then Watchlist Alerts

-

From here, decide which alerts you want to receive via email for each company in your Watchlist by toggling the buttons

Setting up mobile app push notifications

To receive push notification alerts about your followed companies, which is one of our most popular features, you must first download the Vox Markets app.

(Follow these links to download the Vox Markets app on iOS or Android.)

Once you have the app, it’s then vital to make sure you have enabled notifications for Vox Markets.

How do I turn on push notifications?

To enable push notifications on iOS:

-

Visit your device’s home screen

-

Click Settings, then Notifications

-

Scroll down to Vox Markets and click “Allow Notifications” on

After notifications have been turned on, you can now choose exactly which push notifications you receive about the companies you follow – find out how in the next step.

3. Personalise your push notifications

One of the most popular aspects of Vox Markets is our push notification service, which lets you get live alerts about your followed companies sent directly to your phone.

However, to ensure you are receiving the best alerts for you, we recommend tailoring your push notifications so you get the alerts that you want.

Which push notifications and RNS alerts can I get on Vox Markets?

On Vox Markets, you can get push notification alerts for the following:

RNS – Get a notification when a company you follow issues an RNS

Press – When a followed company is in the news

Podcast – When a Vox Markets podcast is published

Broker Notes – When a broker note is published about a company you follow

Company Squawks – When a followed company Squawks (Squawks are posts)

Followers – When someone follows you on Vox

Likes – When someone likes a Squawk you posted

Comments – When someone comments on your Squawk

Chat – When you get a new chat message

How do I personalise my push notification alerts?

To customise which of these notifications you want to receive, open the app and follow these steps:

-

Click the More section in the bottom right hand corner

-

Then hit the cog symbol ( ) in the top right

) in the top right

-

Then choose which alerts you want to receive

4. Access full company details

In addition to our live updates and news service, Vox Markets was also designed to be your one stop research platform for listed companies.

Our platform aggregates vital company information and key details about all UK listed companies – whether FTSE, Main or AIM – into one place.

What company information is available on Vox Markets?

The company information we collect on the platform includes:

Where do I find this company information?

Below we have explained how to find all this company information on both desktop and mobile.

Desktop

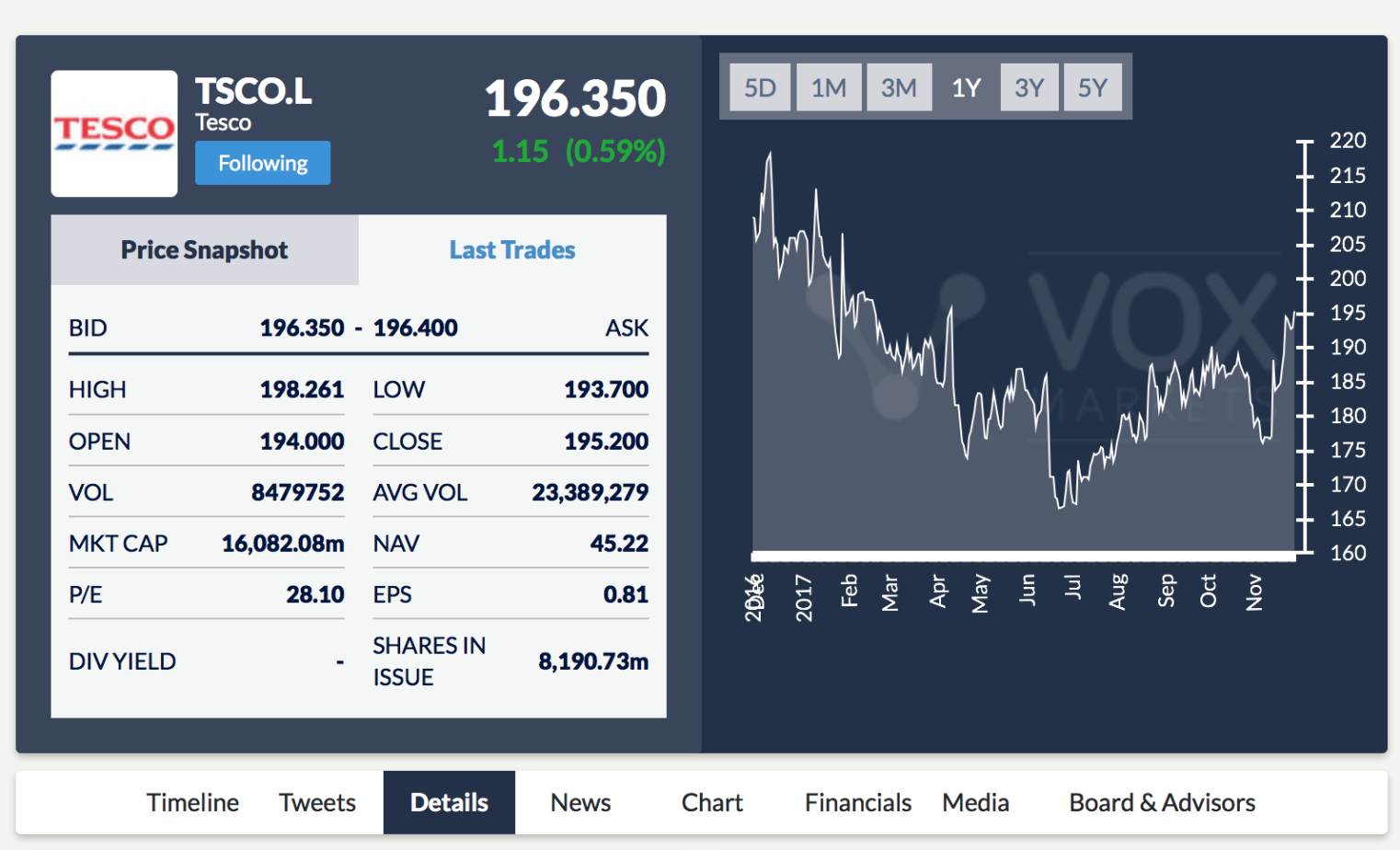

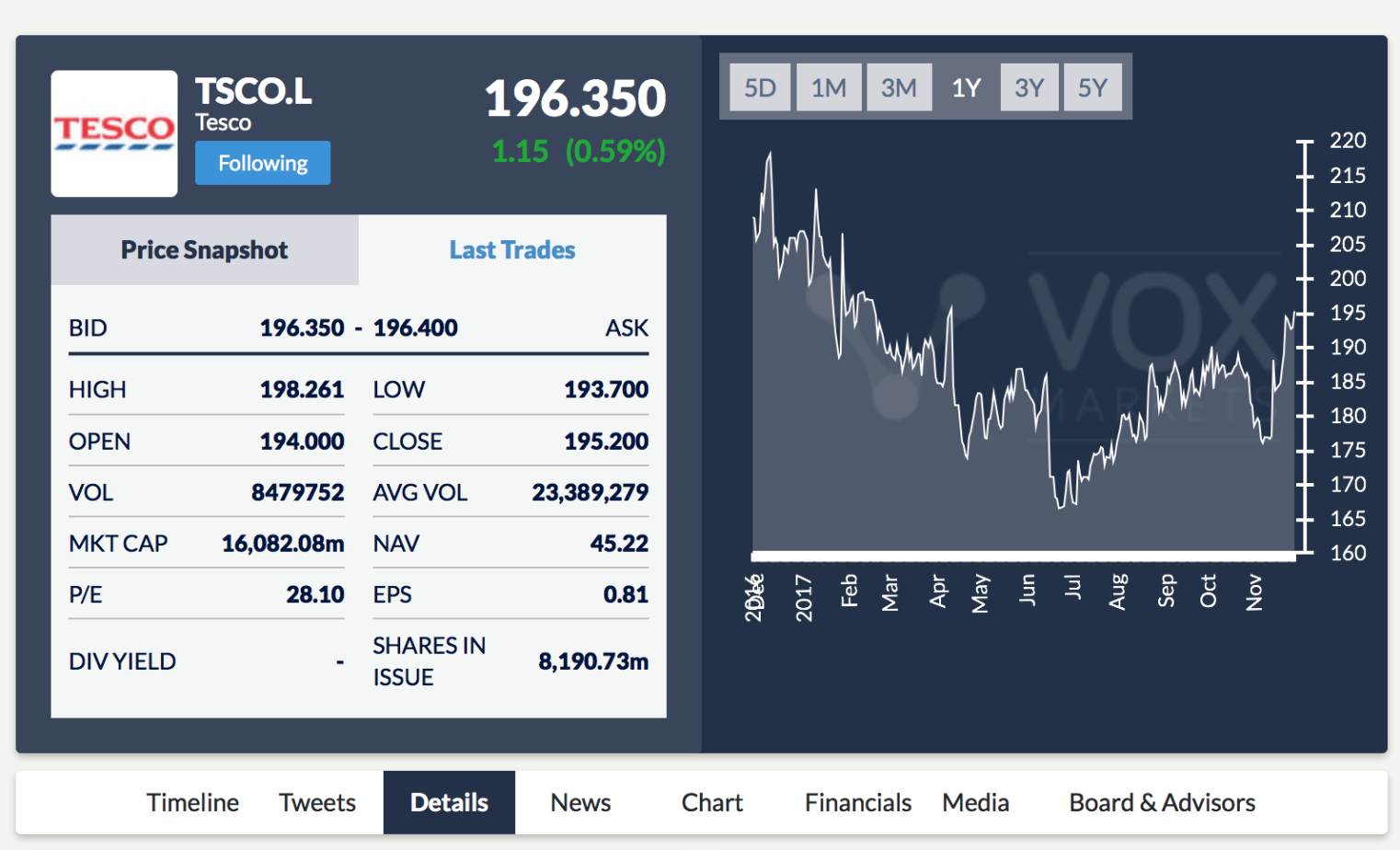

On desktop, you can access all these details by clicking on a company page and browsing through the various sections below the price chart (Timeline / Tweets / Details / News / Chart / Financials / Media / Board & Advisors).

Mobile

On mobile, you access the full company details in a slightly different way.

To do this:

-

Click on a company’s profile by tapping their name or icon anywhere in the app

-

This opens the following menus: Timeline, RNS, Snapshot and Last Trades

To access the rest of the details (Pricing, Broker Recs, Key Dates etc) you have to:

-

Swipe right when in a company page (where you see the four grey dots at the bottom of the screen)

-

This opens up a new section where you can find details like Pricing, Broker Recs, Key Dates and Presentations

-

If you swipe right again, it opens up the Income Statement and Balance Sheet section

-

Swipe right once more to find information about a company’s Board of Directors and Advisors

We hope this guide has been useful and will help to improve your Vox Markets experience – if you have any other questions or comments about how to use the platform, do get in touch here.

Vox Markets is the easiest way to track news and updates about the stock market companies you follow.

As well as offering the fastest RNS alerts and push notifications service, Vox Markets also aggregates vital information on UK listed companies such as pricing data, broker notes, analyst research and press mentions onto one community platform.

Register for Vox Markets:

Download Vox Markets:

Bert Monro, Head of Business Development at Hummingbird Resources #HUM describes their first gold pour at their Mali Mine.

Hummingbird Resources (AIM: HUM) is building a leading gold production, development and exploration company. The Company has two core gold projects, the Yanfolila Gold Mine in Mali and the Dugbe Gold Project in Liberia.

To add Hummingbird Resources #HUM to your Vox Markets watchlist, click here and tap the, “Follow” button.

(Interview starts at 1 minute 32 seconds)

PLUS

Bert Monro, Head of Business Development at Hummingbird Resources #HUM describes their first gold pour at their Mali Mine.

Hummingbird Resources (AIM: HUM) is building a leading gold production, development and exploration company. The Company has two core gold projects, the Yanfolila Gold Mine in Mali and the Dugbe Gold Project in Liberia.

To add Hummingbird Resources #HUM to your Vox Markets watchlist, click here and tap the, “Follow” button.

(Interview starts at 1 minute 32 seconds)

PLUS

Tim Crane, Non Executive Director of Seeing Machines #SEE and General Manager of Caterpillar Services talks about his side of the business.

Seeing Machines, (LSE: SEE) is an industry leader in computer vision technologies which enable machines to see, understand and assist people. The Company deploys its FOVIO machine learning vision platform to deliver real-time understanding of drivers through AI analysis of heads, faces and eyes for Driver Monitoring Systems (DMS), which monitor driver attention state including drowsiness and distraction.

To add Seeing Machines #SEE to your Vox Markets watchlist, click here and select the, “Follow”, button.

(Interview starts at 9 minutes 20 seconds)

PLUS

Tim Crane, Non Executive Director of Seeing Machines #SEE and General Manager of Caterpillar Services talks about his side of the business.

Seeing Machines, (LSE: SEE) is an industry leader in computer vision technologies which enable machines to see, understand and assist people. The Company deploys its FOVIO machine learning vision platform to deliver real-time understanding of drivers through AI analysis of heads, faces and eyes for Driver Monitoring Systems (DMS), which monitor driver attention state including drowsiness and distraction.

To add Seeing Machines #SEE to your Vox Markets watchlist, click here and select the, “Follow”, button.

(Interview starts at 9 minutes 20 seconds)

PLUS

Patrick Cullen, CEO on Connemara Mining #CON describes their on going progress at their zinc and gold assets in Ireland.

Connemara Mining Company plc (“Connemara”) was established in 2004 by veterans of the Irish mining industry to exploit zinc and gold opportunities. It currently holds 47 prospecting licences in Ireland.

To add Connemara Mining #CON to your Vox Markets watchlist, click here and tap the, “Follow”, button.

(Interview starts at 24 minutes 52 seconds)

PLUS

Patrick Cullen, CEO on Connemara Mining #CON describes their on going progress at their zinc and gold assets in Ireland.

Connemara Mining Company plc (“Connemara”) was established in 2004 by veterans of the Irish mining industry to exploit zinc and gold opportunities. It currently holds 47 prospecting licences in Ireland.

To add Connemara Mining #CON to your Vox Markets watchlist, click here and tap the, “Follow”, button.

(Interview starts at 24 minutes 52 seconds)

PLUS

Merlin Marr-Johnson, CEO Erris Resources #ERIS which floated yesterday, talks about the companies zinc assets in Ireland and gold assets in Sweden.

Erris Resources was established in 2012 as a mineral exploration and development company. It was initially set up with the aim of exploring the northwest of Ireland for gold and base metals and has subsequently expanded into Sweden with a funded exploration programme with Centerra, pursuant to the Centerra JV agreement.

To add Eriss Resources #ERIS to your Vox Markets watchlist, click here and tap the, “Follow”, button.

(Interview starts at 33 minutes 48 seconds)

Merlin Marr-Johnson, CEO Erris Resources #ERIS which floated yesterday, talks about the companies zinc assets in Ireland and gold assets in Sweden.

Erris Resources was established in 2012 as a mineral exploration and development company. It was initially set up with the aim of exploring the northwest of Ireland for gold and base metals and has subsequently expanded into Sweden with a funded exploration programme with Centerra, pursuant to the Centerra JV agreement.

To add Eriss Resources #ERIS to your Vox Markets watchlist, click here and tap the, “Follow”, button.

(Interview starts at 33 minutes 48 seconds)

(Feature starts at 45 minutes 43 seconds)

The Top 5 Most Followed Companies on Vox Markets in the Last 24 Hours were:

1. Lightwave #LWRF

2. Conroy Gold Natural Resources #CGNR

3. Hummingbord Resources #HUM

4. Westminster Group #WSG

5. Vela Technologies #VELA

To add any of these companies to your Vox Markets watchlist just click on their name and tap the, “Follow” button.

(Feature starts at 45 minutes 43 seconds)

The Top 5 Most Followed Companies on Vox Markets in the Last 24 Hours were:

1. Lightwave #LWRF

2. Conroy Gold Natural Resources #CGNR

3. Hummingbord Resources #HUM

4. Westminster Group #WSG

5. Vela Technologies #VELA

To add any of these companies to your Vox Markets watchlist just click on their name and tap the, “Follow” button.

The Top 5 Most Liked RNS’s on Vox Markets in the last 24 hours were:

1. Motif Bio #MTFB – Notes statement from Amphion Innovations

2. Vast Resources #VAST – Interim Results

3. SDX Energy #SDX – Commencement of operations at ELQ-1 well, Morocco

4. Hummingbird Resources #HUM – First Gold Poured at Yanfolila Gold Mine

5. Westminster Group #WSG – Major Middle East Project Opportunity Update

To add any of these companies to your, Vox Markets, watchlist just click on their name and tap the, “Follow” button.

The Top 5 Most Liked RNS’s on Vox Markets in the last 24 hours were:

1. Motif Bio #MTFB – Notes statement from Amphion Innovations

2. Vast Resources #VAST – Interim Results

3. SDX Energy #SDX – Commencement of operations at ELQ-1 well, Morocco

4. Hummingbird Resources #HUM – First Gold Poured at Yanfolila Gold Mine

5. Westminster Group #WSG – Major Middle East Project Opportunity Update

To add any of these companies to your, Vox Markets, watchlist just click on their name and tap the, “Follow” button.

To subscribe to my blog click here

To subscribe to my blog click here

3 Further Reasons to add Energiser Investments #ENGI to your Watchlist

2 Overlooked Companies, That Could Be About to Release Signficant News

3 Further Reasons to add Energiser Investments #ENGI to your Watchlist

2 Overlooked Companies, That Could Be About to Release Signficant News

3 Reasons to add Flybe #FLYB to you Watchlist

3 Reasons to add Flybe #FLYB to you Watchlist

3 Reasons to add Flying Brands to your Watchlist

3 Reasons to add Flying Brands to your Watchlist

1 More Reason to add Harvest Minerals to your Watchlist

1 Further Reason to add Harvest Minerals to your Watchlist

Another 3 reasons to add Harvest Minerals to your Watchlist

3 reasons to put Harvest Minerals on your Watchlist

1 More Reason to add Harvest Minerals to your Watchlist

1 Further Reason to add Harvest Minerals to your Watchlist

Another 3 reasons to add Harvest Minerals to your Watchlist

3 reasons to put Harvest Minerals on your Watchlist

One Further Reason to add Horizonte Minerals #HZM to your Watchlist

To read my blog on Horizonte Minerals click here

One Further Reason to add Horizonte Minerals #HZM to your Watchlist

To read my blog on Horizonte Minerals click here

3 Reasons to add Jangada Mines #JAN to your Watchlist

3 Reasons to add Jangada Mines #JAN to your Watchlist

4 Reasons to add Kodal Minerals #KOD to your Watchlist

4 Reasons to add Kodal Minerals #KOD to your Watchlist

3 reasons to add Stellar Diamonds #STEL to your Watchlist

3 reasons to add Stellar Diamonds #STEL to your Watchlist

To read my blog post on #TLOU Energy click here

To read, “5 Reasons I bought more Shares in Tlou Energy This Week” click here

11 Quick Reasons to add Tlou Energy #TLOU to your Watchlist

To read my blog post on #TLOU Energy click here

To read, “5 Reasons I bought more Shares in Tlou Energy This Week” click here

11 Quick Reasons to add Tlou Energy #TLOU to your Watchlist

3 Reasons to add Upland Resources #UPL to your Watchlist

To read my blog post on Upland Resources #UPL click here

To read my follow up article on Upland Resources: The Sensible and Sexy Asset Strategy, click here

2 Overlooked Companies, That Could Be About to Release Signficant News

3 Reasons to add Upland Resources #UPL to your Watchlist

To read my blog post on Upland Resources #UPL click here

To read my follow up article on Upland Resources: The Sensible and Sexy Asset Strategy, click here

2 Overlooked Companies, That Could Be About to Release Signficant News

1 Further Reason to add Utilitywise (UTW) to your Watchlist

3 Reasons to add Utilitywise (UTW) to you watchlist

1 Further Reason to add Utilitywise (UTW) to your Watchlist

3 Reasons to add Utilitywise (UTW) to you watchlist

2 Further reasons to add Versarien #VRS to your Watchlist

3 reasons to add Versarien #VRS to your Watchlist

2 Further reasons to add Versarien #VRS to your Watchlist

3 reasons to add Versarien #VRS to your Watchlist

How to get company RNS releases sent straight to the front screen of your smartphone, as soon as they release them (for free) in 3 easy steps.

1. Download the Vox Markets app by clicking here (for either iPhone or Android).

2. Search for a company you want to receive the RNS’s from.

3. Click, “Follow” on that company’s page.

If you find this podcast useful please could you give it a 5 star rating and review on iTunes by clicking here and I’ll return the favour by giving you a mention on the podcast!

The content of this podcast (or content associated with it) is not intended as investment advice and people featured may hold positions in the companies they talk about. Please do your own research.

How to get company RNS releases sent straight to the front screen of your smartphone, as soon as they release them (for free) in 3 easy steps.

1. Download the Vox Markets app by clicking here (for either iPhone or Android).

2. Search for a company you want to receive the RNS’s from.

3. Click, “Follow” on that company’s page.

If you find this podcast useful please could you give it a 5 star rating and review on iTunes by clicking here and I’ll return the favour by giving you a mention on the podcast!

The content of this podcast (or content associated with it) is not intended as investment advice and people featured may hold positions in the companies they talk about. Please do your own research.

Ed Dawson, CEO & Managing Director of Prospex Oil & Gas plc talks about Successful Completion of Podere Maiar-1 well.

Ed Dawson, CEO & Managing Director of Prospex Oil & Gas plc talks about Successful Completion of Podere Maiar-1 well.

Colin Bird, Chairman of Xtract Resources talks about the strategic investment in Manica alluvial operator

Colin Bird, Chairman of Xtract Resources talks about the strategic investment in Manica alluvial operator

Christopher Theis, Chief Executive Officer of Path Investments talks about the conditional farm-in agreement (the “FIA”) with 5P Energy GmbH (“5P Energy”)

Christopher Theis, Chief Executive Officer of Path Investments talks about the conditional farm-in agreement (the “FIA”) with 5P Energy GmbH (“5P Energy”)

Martin Luke interviews Myles Campion, Technical Director of Ferrum Crescent.

Martin Luke interviews Myles Campion, Technical Director of Ferrum Crescent.

Joe Salomon, Managing Director of Oilex #OEX talks about Placement to New Cornerstone Shareholder.

Joe Salomon, Managing Director of Oilex #OEX talks about Placement to New Cornerstone Shareholder.

David Buik covers Today’s Fayre.

David Buik covers Today’s Fayre.